From 2016 to 2018, I was spending closer to $6000 per month. After returning from our cross-country adventure, that number spiked. It's a valuable practice.Įarlier this decade - after my divorce but before my RV trip - my monthly spending averaged about $4000. I've been doing this since 1993 (with occasional breaks). My January 2020 SpendingĪs you know, I track every penny I spend. January was - by far - my best month with money in years. There's been an unexpected benefit to my quest to become a better version of me. I expect this to provide an additional boost to my well-being. Over the next six weeks, I plan to integrate two additional changes into my life: I'm going to begin exercising regularly and I'm going to cut back on videogames.

Taken together, these three changes have mitigated my mental health problems and made me more productive. I've had a few drinks in February, and it's been interesting to see how it affects me, both in the moment and then for days after. In fact, I didn't touch a drop of alcohol during January. This year, I'm generally rising at 4:00 or 4:30, which means I'm at the office by five. I tend to be an early riser anyhow, but early for me means about six o'clock.

I do not allow myself to play games (or engage in other shenanigans) at the office.

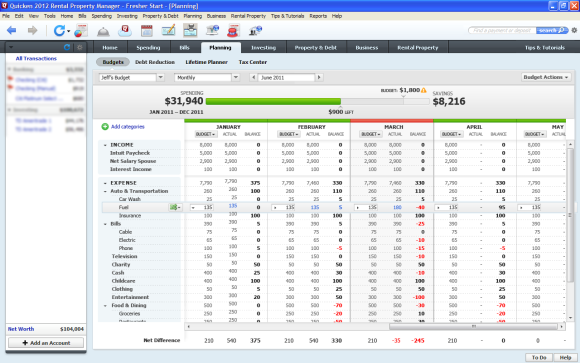

#YOU NEED A BUDGET VS QUICKEN SOFTWARE#

Overall this is a solid cloud-based software solution that should help you get on top of your finances. You Need a Budget (opens in new tab) continues to improve with each successive release. All in all then we’d like to see this beefed up in future iterations. While email support is okay, it’s not quite the same, although another alternative is to consult the forums.Īgain though you're not always guaranteed the information you get is going to be 100% reliable. There is a step-by-step guide and FAQs, which should answer many of your queries, but it would always be a bonus to be able to contact a real person for those more unusual requests.

There’s no phone support, which considering this is a paid-for service leaves You Need a Budget sorely lacking. This is even more of a point when you consider the ongoing subscription charge for using the service. The area of support has to currently be one of You Need a Budget’s weakest areas and could do with some improvement. The lack of real people support is something of a negative however (Image credit: You Need a Budget) Support

0 kommentar(er)

0 kommentar(er)